tax shield formula uk

Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a. Web formula shield tax uk.

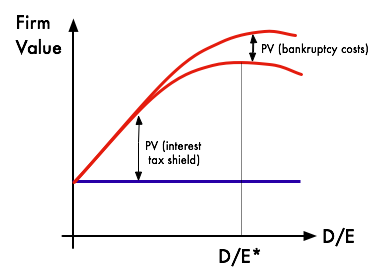

Out Of The Perfect Capital Market Role Of Taxes Ppt Download

Depreciation Tax Shield Formula.

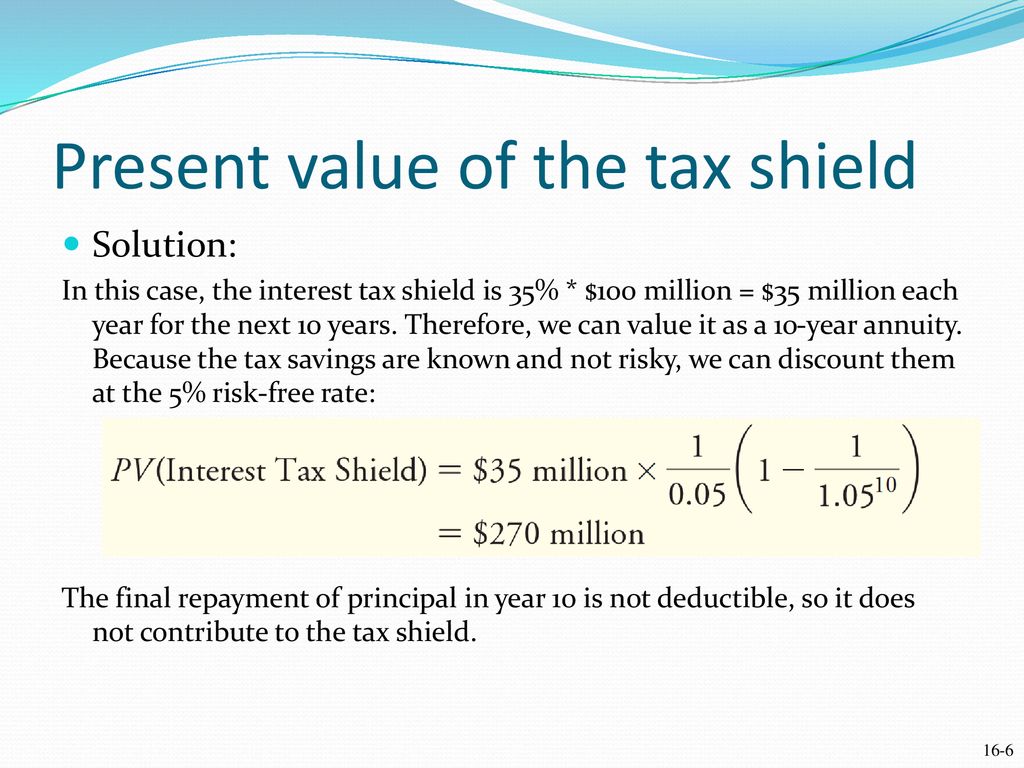

. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. The formula for calculating the interest tax shield is as follows. Class 36 up to 1007o.

The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Tax Shield Amount of tax-deductible expense x Tax rate. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. Without the depreciation tax shield the company will have to pay 250000 in taxes as it has a 25 tax rate and 1000000 in revenues. Depreciation Tax Shield Depreciation Expense Tax Rate.

For instance if the tax rate is 210 and the. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Minimum 5 years and Maximum 40 years Class 14 Length of life of property.

Tax Shield formula. For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the. Interest Tax Shield Formula.

If feasible annual depreciation expense can be manually calculated by subtracting the salvage. The formula for this calculation can be presented as follows. What is the formula for tax shield.

Class 13 original lease period plus one renewal period. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. Web A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

Or the concept may be applicable but have less. The top-specification online P11D Personal Tax and Partnership Tax software for tax professionals accountants and business owners written and developed by taxation experts. Web Tax Shield Deductible.

Companies using a method of accelerated depreciation are able to save more money on tax payments due to the. Interest Tax Shield Interest Expense Tax Rate. On the other hand if we take the.

1 For example because interest on debt is a tax-deductible expense taking. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest. Web formula shield tax uk.

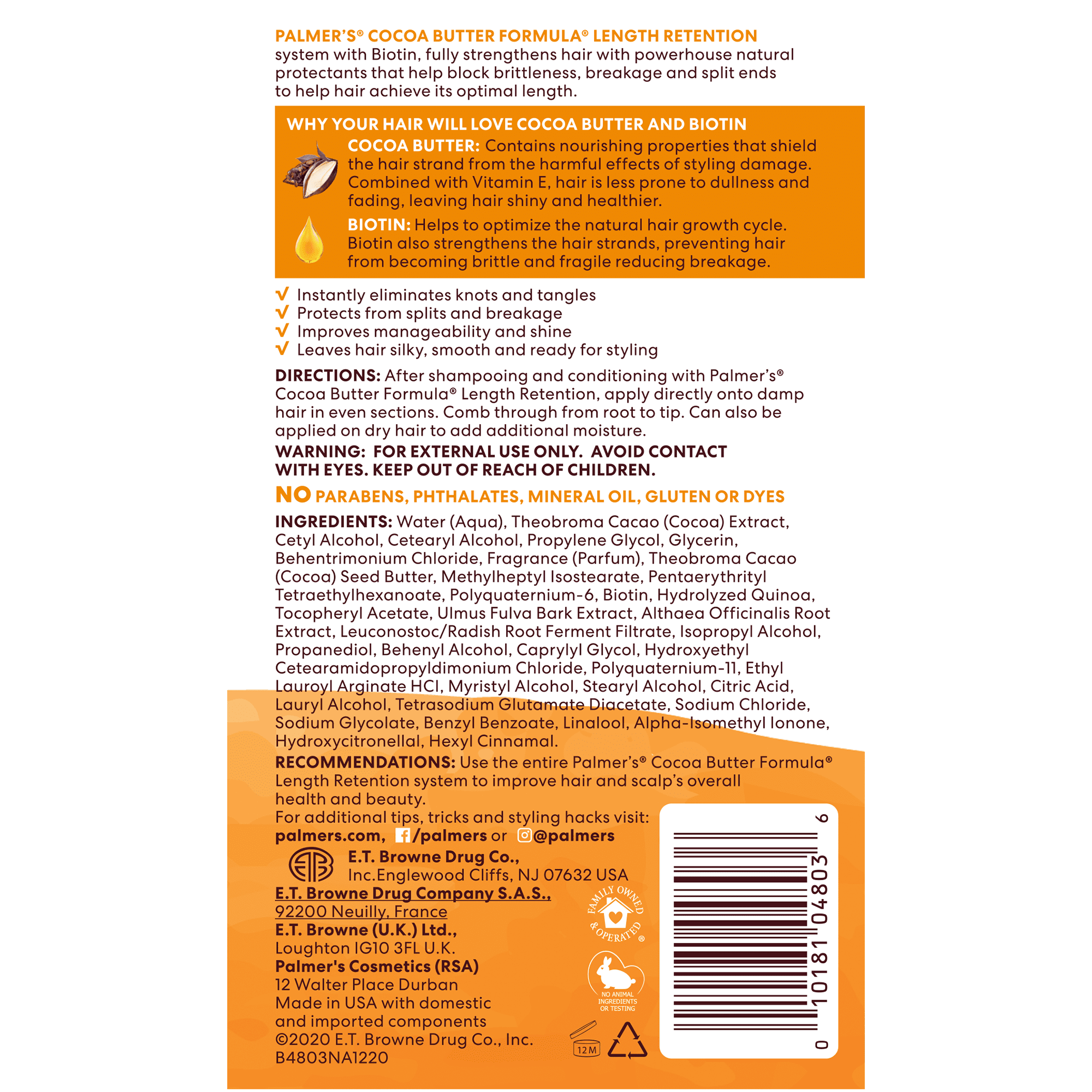

Palmer S Cocoa Butter Formula Biotin Length Retention Leave In Conditioner 8 5 Fl Oz Walmart Com

F1 S Miami Grand Prix 2022 Brings America Its Drive To Survive Moment Bloomberg

Tax Shield Definition And Formula Bookstime

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Reckitt Gains As Company Weighs Sale Of Baby Formula Unit Bloomberg

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

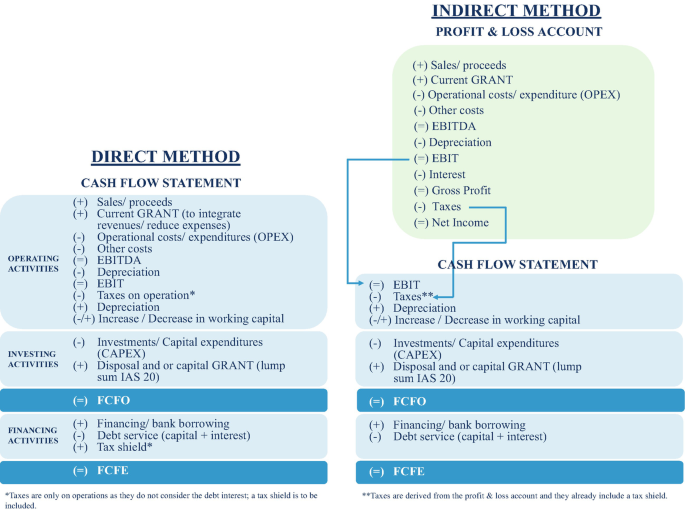

Principles Of Capital Budgeting For Infrastructure Financing Springerlink

Amazon Com Palmer S Cocoa Butter Biotin Length Retention 2 Step Hair Mask 1 Ounce Beauty Personal Care

Interest Tax Shield Formula And Calculator Step By Step

Trade Off Theory Of Capital Structure Wikipedia

Pdf Tax Rate And Non Debt Tax Shield

Tax Shield Formula How To Calculate Tax Shield With Example

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis